Table of Content

- Home Equity Loans & Lines of Credit Lenders in Huntington Beach

- Products by City in Michigan

- Huntington Woods, Michigan Home Equity Line of Credit Rates

- Why choose a Home Equity Line of Credit?

- Interested in a Home Equity Loan instead?

- What are your current balances and payments?

- West Virginia Cities > Huntington

- Huntington Home Equity Line of Credit

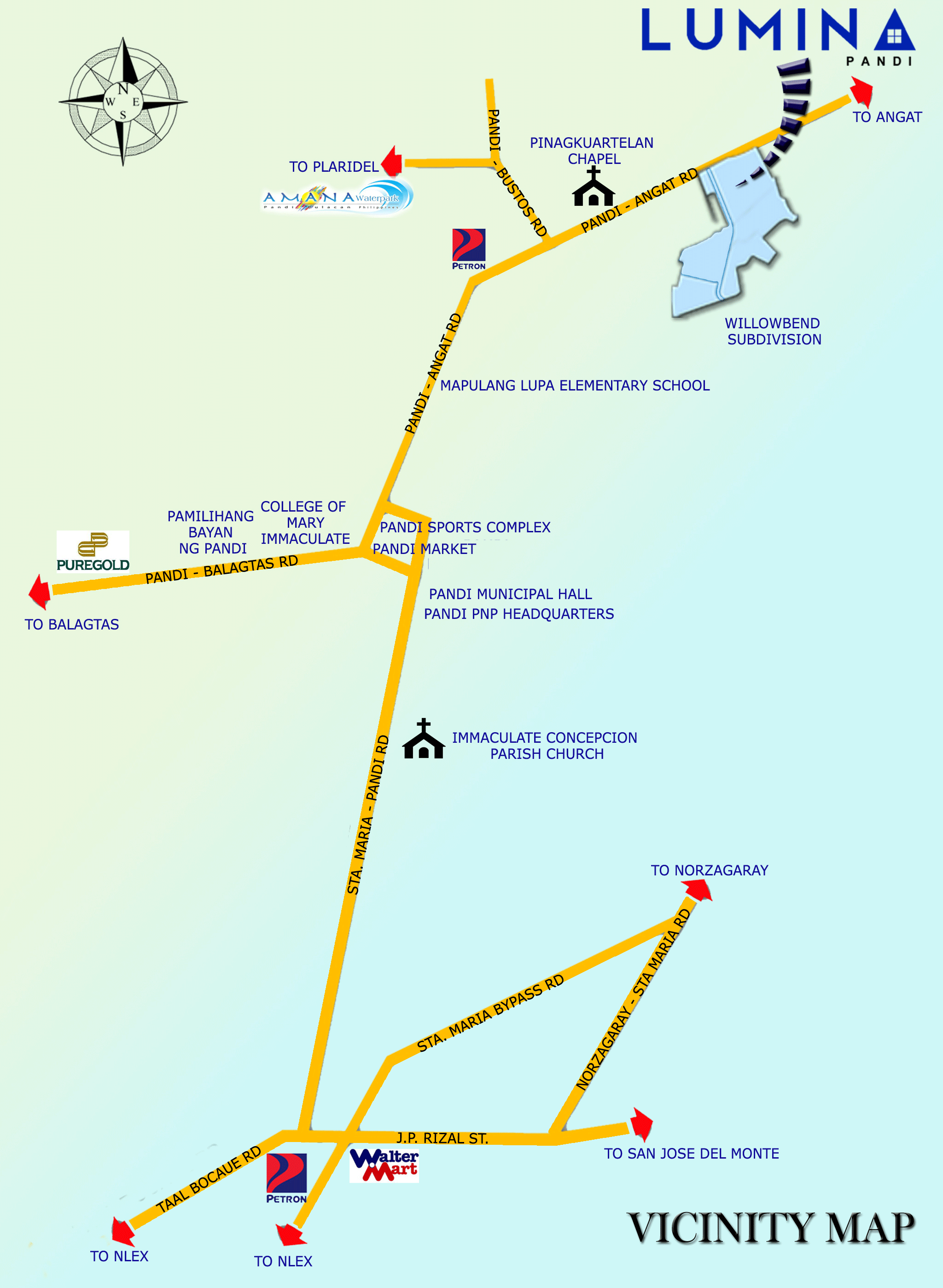

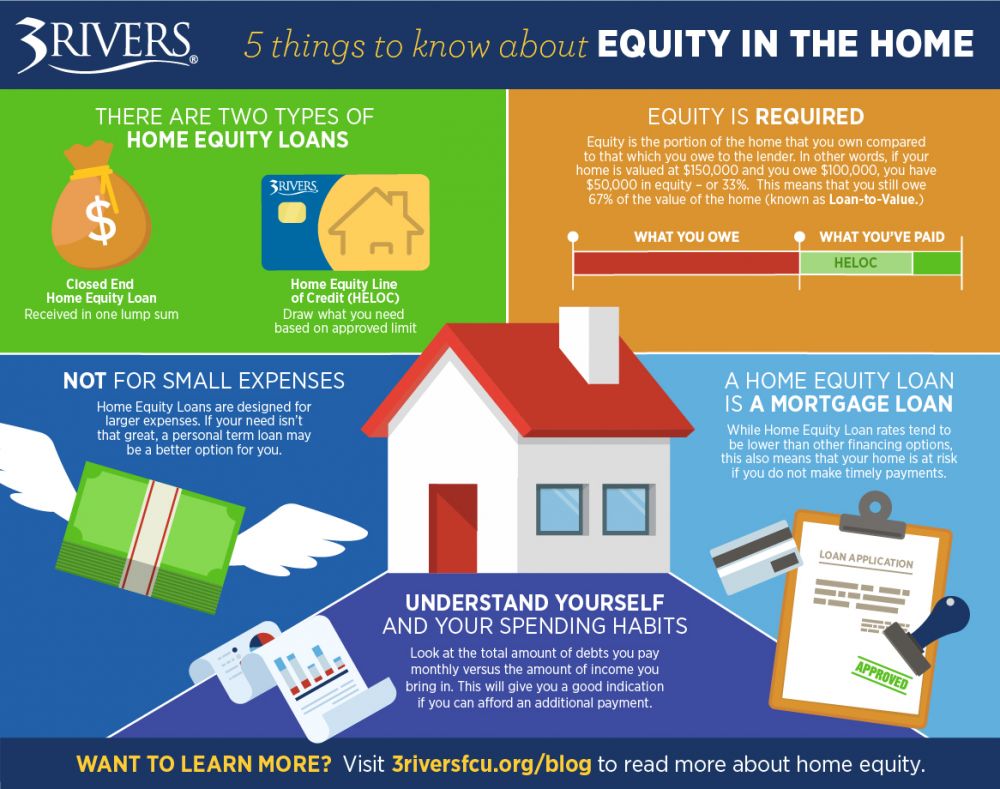

Talk to a banker for more information on your particular situation. Since you pay interest only as you go and on what you draw out over the first 10 years, the affluent, particularly those who are self-employed, can use a home equity line of credit to float day-to-day expenses. If you qualify, you can even use a home equity line of credit to finance the purchase of another home while you are trying to sell your current home. To do this you need to meet the debt to income ratio guidelines and down payment guidelines set forth by the new mortgagor. A Home Equity Loan from Huntington could be your first step toward financial freedom. As a homeowner, you'll quickly see the value in a loan that has no application fees, easy online account management and fixed monthly payments due on the day of your choosing.

Withdraw funds as you need them to pay for expenses for your home, like renovations. A Home Equity Loan is a lump sum given to you immediately that you pay back over the course of the agreed upon terms. Online account access lets you save time, view your loan balance, monitor transaction history and make payments with free Bill Pay.

Home Equity Loans & Lines of Credit Lenders in Huntington Beach

If I could give lower than a one start rating I would. Rates remain near historic lows, which means this is the ideal time to lock in a great rate. Take a few moments right now to review our rate tables to compare all your options and see just how easy it can be for your home to start paying you back for a change.

Insurance must be carried on the real property securing the account, and flood insurance must be carried if the structure on the real property is located in a Special Flood Hazard Area. The amount of savings realized with debt consolidation varies by loan. Since a home equity line of credit may have a longer term than some of the bills being consolidated, there may not be a savings over the entire time of the line if you make only the minimum payments. Federally Guaranteed Student Loans and other loans with special government benefits should not be consolidated because you may lose the benefits. For many years, we have written about appropriate and inappropriate reasons to have a home equity line of credit.

Products by City in Michigan

10-year rates have fallen from 3.05% to as low as 2.35% over the last six months. Fears of a global recession and Brexit uncertainty have caused money to pour into the US and to drive down what are still comparatively high US rates. Barring a global recession, it does seems that long-term interest rates should move higher as the Fed reduces its portfolio and as the risks in the US deficit and debt come to the fore. One time lump sum loan amount or as a home equity line of credit where you can draw cash as you need it. All Huntington Federal lending products are subject to credit review and approval.

Home Equity Line of Credit - Rates are based on a variable rate, second lien revolving home equity line of credit Michigan for an owner occupied residence with an 80% loan-to-value ratio for line amounts of $ 50,000. Discount indicates the amount of reduction in the Rate for having monthly payments automatically deducted from an account and/or for having other relationship accounts with the institution, expressed as a percentage. Conditions ‘No closing costs’ indicates that customer is not required to pay closing costs on the line of credit. ‘With closing costs’ indicates that customer is required to pay closing costs on the line of credit. Home Equity Line of Credit - Rates are based on a variable rate, second lien revolving home equity line of credit California for an owner occupied residence with an 80% loan-to-value ratio for line amounts of $ 50,000.

Huntington Woods, Michigan Home Equity Line of Credit Rates

This table does not include all companies or all available products. "Use money that's already yours to start a home improvement project, consolidate debt or fund a vacation getaway." "Using your home's equity wisely could actually help increase your property value, save you thousands in interest payments, even set you on a path toward opportunities for future success."

It's easy to pay for unexpected medical bills, car repairs or credit card debt. Our line of credit offers checks, PCL Mastercard® or Online Banking options. Every day, about 10,000 baby boomers turn 65, the “traditional” age for retirement – or at least, the age when many people decide to call it quits and leave their jobs. In years past, many retirees could count on a workplace pension combined with Social Security benefits and personal savings to help them afford their retirement as long as they had modest financial needs. Long-term interest rates present a real conundrum here.

Depending on customer's qualifications, variable APR's range for line amounts as stated above. Was approved for an equity loan at the end of January. They then hit my credit report with multiple credit check because they let the file lapse due to them dragging their feet. Because of the credit check they then said they can't of give me the original offer because of the credit check lowering my score which they caused because they kept letting the file lapse because they were taking so long. I will be contacting the BBB and also a credit attorney because of the issues they ha e now caused. Please if you are looking for an equity loan please please please find a different lender.

If you are the owner of the logo and wish for us to remove or change the logo, please contact us. You may estimate this amount, but to be more accurate consult your most recent statement. If you wish to take cash out when you consolidate, enter that amount as a loan balance. Asterisk-Free Checking® and Voice Credit Card® are federally registered service marks of Huntington Bancshares Incorporated.

While the aforementioned information has been collected from a variety of sources deemed reliable, it is not guaranteed and should be independently verified. ERATE does not endorse any of the lenders on our website. Logos appearing on this page were obtained from their respective websites by ERATE for the purposes of product comparison or editorial purposes. ERATE is not directly affiliated with or endorsed by the lenders or financial institutions listed here.

I have plenty of friends who have paid off their mortgages and loans as soon as they came into money, and vowed, ever since, never to take out another loan in their lives. I wouldn't advise betting through market instrumnets one way on another on the direction of interest rates here. But, I’d heed the advice of Gundlach and others not to become too complacent about lower rates. Therefore, if you are thinking about remortgaging or locking in a home equity loan, this is as good of a time as any to take action. The information contained on this website is provided as a supplemental educational resource. Readers having legal or tax questions are urged to obtain advice from their professional legal or tax advisors.

Let’s examine the basics of home equity lines of credit first in order to understand what makes them appealing. First, home equity lines of credit are typically less costly and more flexible than home equity loans. Importantly, as the borrower, you only borrow the amount that you need, and thus you only pay interest on the amount that you need and draw.

In particular, home equity lines of credit can be used to consolidate more expensive debt (credit card, education loans, etc.) and can be used by consumers to even out irregular cash flow. We’ve even cited cases where the affluent can use home equity lines to their advantage. Borrower-paid title insurance may be required on loan amounts greater than $750,000. Mail-away Fees, which also include a notary fee, range from $125 to $375 and will apply when closing is facilitated by a third-party on Huntington's behalf. Customers using a condominium as collateral may be charged a fee by their condo association to complete a questionnaire by the appraisal company. See a banker for more information about current rates and terms.

If you're retired or you're planning on retiring soon, now is a great time to explore home equity loans. From the news this week, we have an example of a case where one really shouldn’t be drawing on their home equity line. Michael Cohen has set a precedent that we do not recommend you follow. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear.

Home equity loans and lines also subject to acceptable appraisal and title search. Low introduction interest rate then prime plus 1.89% when savings accounts are less than 1.0% smh. It is still lower than other forms of credit however when you have a credit score over 800, I would think to be treated better.